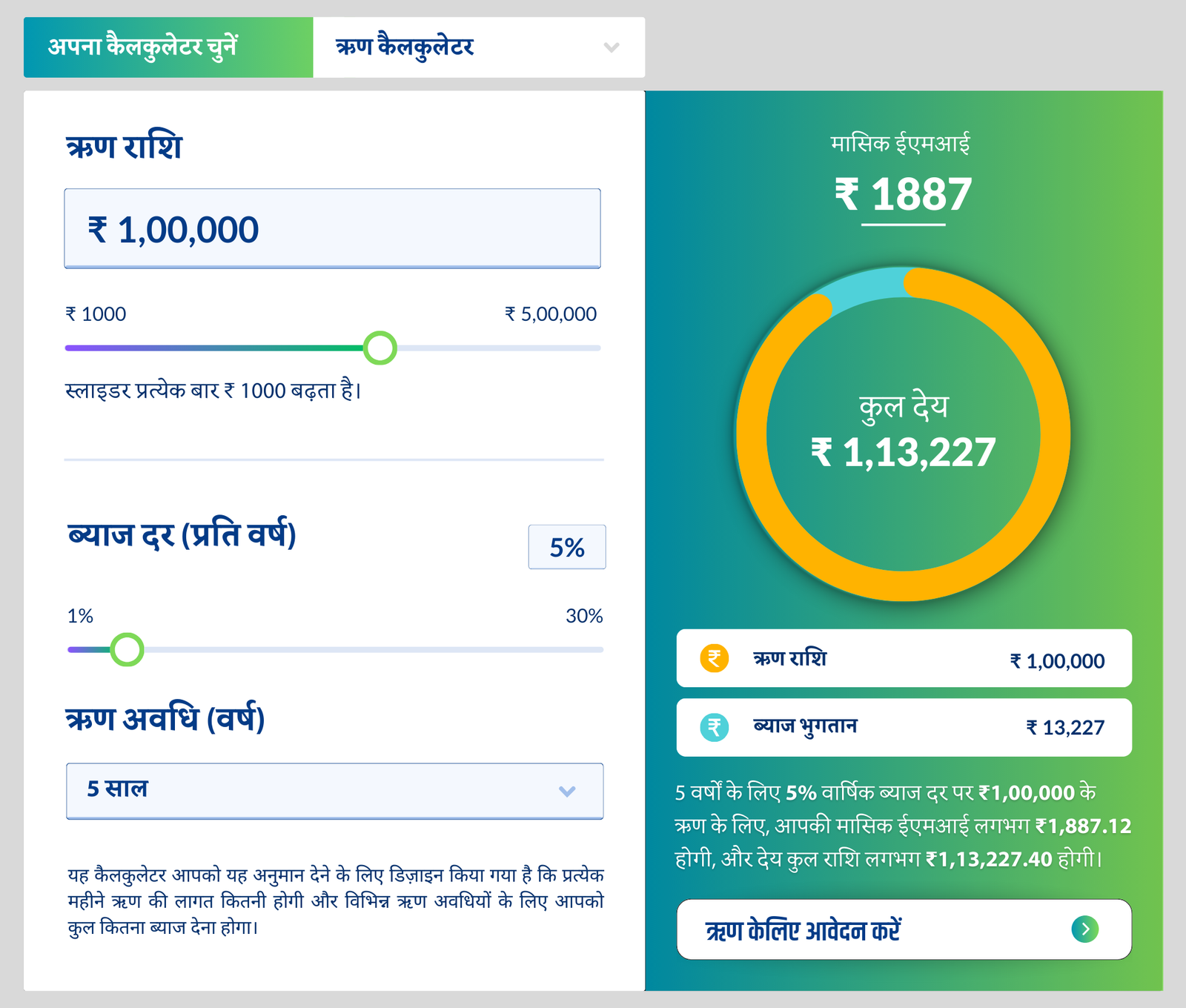

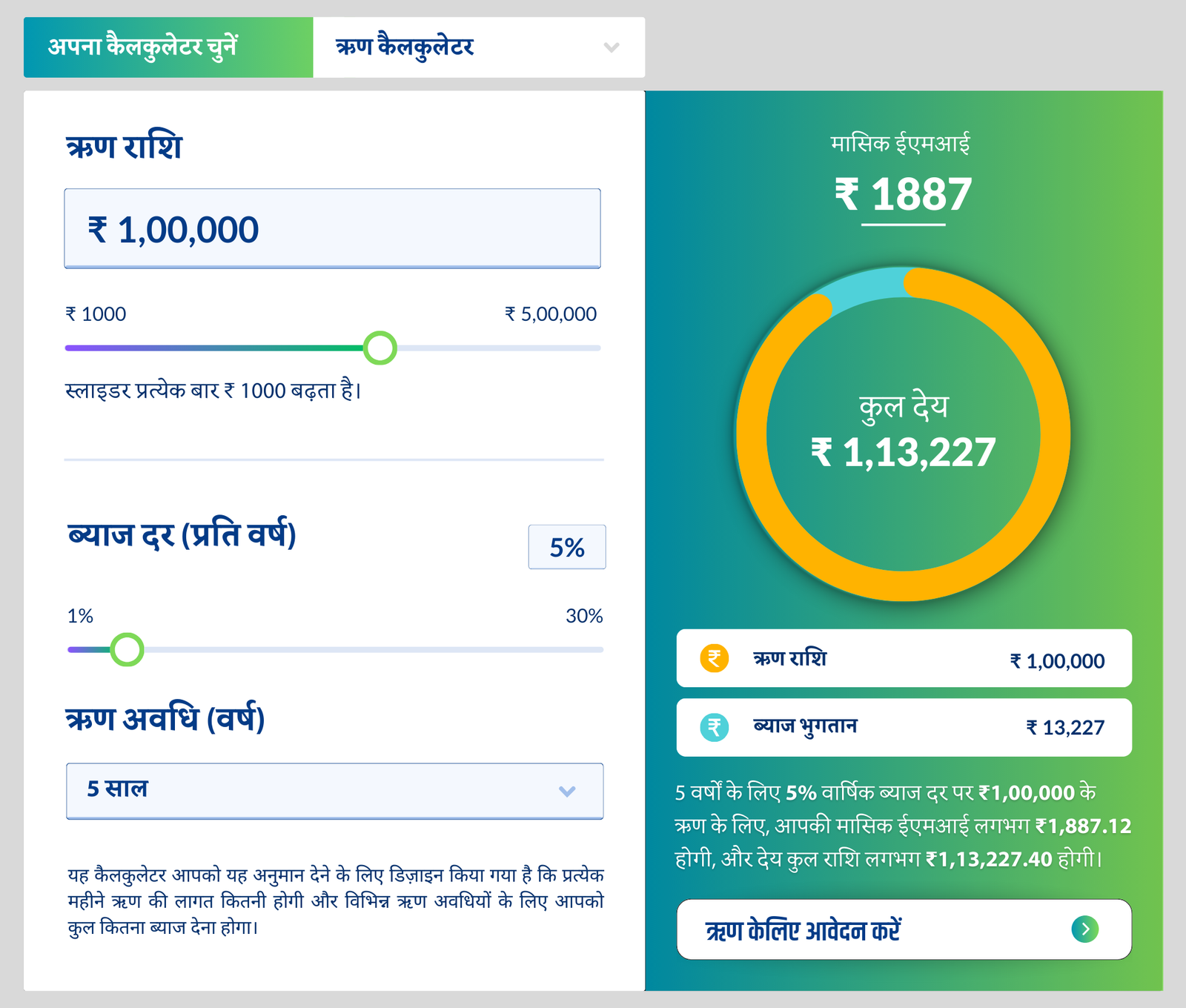

Kaabharat Insights: Make Smarter Loan Decisions with Online Loan Calculators

Make better loan choices with online calculators – a quick guide by Kaabharat and Samriddhi Finance for smart financial planning.

Submit your details to check eligibility.

Submit your details to check eligibility.

Taking a personal loan can be a smart step toward achieving your goals — whether it’s renovating your home, supporting your child’s education, or managing unexpected expenses. At Kaabharat Finance, we assist salaried professionals in securing personal loans through our network of verified and trusted partners, offering a safe, fast, and hassle-free process. In today’s fast-paced India, where time and trust matter, choosing a loan with minimal processing and no hidden charges can make all the difference. Begin your journey toward financial growth and stability with Kaabharat — your trusted guide in getting the right support, right when you need it.

Make better loan choices with online calculators – a quick guide by Kaabharat and Samriddhi Finance for smart financial planning.

Installment loans offer a fixed amount of money repaid over time through scheduled payments, making them ideal for big purchases, emergencies, or debt consolidation. With predictable terms and interest rates, they provide stability and help with budgeting.

A personal loan is a quick and flexible way to meet urgent financial needs without offering any collateral. From debt consolidation to medical emergencies, it offers fast disbursal, fixed EMIs, and can be used for various purposes. Learn how it works and how Kaabharat helps connect you with trusted financers.

Learn how to check your loan eligibility in just a few minutes. Understand key criteria and begin your financial journey confidently with Samriddhi Kaabharat.

Understand the key differences between secured and unsecured loans — from interest rates to risks — so you can choose the best option for your financial needs as a salaried employee.

Top loan options for salaried professionals in India in 2025 include personal loans, salary overdrafts, consumer durable loans, pre-approved credit card loans, and quick loans against salary from trusted banks and NBFCs. These offer flexible, fast, and affordable credit solutions tailored for your needs.

Taking a personal loan can be a smart step toward achieving your goals — whether it’s renovating your home, supporting your child’s education, or managing unexpected expenses. At Kaabharat Finance, we assist salaried professionals in securing personal loans through our network of verified and trusted partners, offering a safe, fast, and hassle-free process. In today’s fast-paced India, where time and trust matter, choosing a loan with minimal processing and no hidden charges can make all the difference. Begin your journey toward financial growth and stability with Kaabharat — your trusted guide in getting the right support, right when you need it.

Make better loan choices with online calculators – a quick guide by Kaabharat and Samriddhi Finance for smart financial planning.

Installment loans offer a fixed amount of money repaid over time through scheduled payments, making them ideal for big purchases, emergencies, or debt consolidation. With predictable terms and interest rates, they provide stability and help with budgeting.

A personal loan is a quick and flexible way to meet urgent financial needs without offering any collateral. From debt consolidation to medical emergencies, it offers fast disbursal, fixed EMIs, and can be used for various purposes. Learn how it works and how Kaabharat helps connect you with trusted financers.

Learn how to check your loan eligibility in just a few minutes. Understand key criteria and begin your financial journey confidently with Samriddhi Kaabharat.

Understand the key differences between secured and unsecured loans — from interest rates to risks — so you can choose the best option for your financial needs as a salaried employee.

Top loan options for salaried professionals in India in 2025 include personal loans, salary overdrafts, consumer durable loans, pre-approved credit card loans, and quick loans against salary from trusted banks and NBFCs. These offer flexible, fast, and affordable credit solutions tailored for your needs.

At Kaabharat, we have partnered with trusted financial networks to help salaried individuals secure personal loans easily. Your data stays safe with us — collected only for processing your loan application.

Kaabharat is an initiative focused on empowering Indians through education, services, and now — financial access. Through verified third-party loan providers, we help salaried individuals connect with suitable loan options.

To check your eligibility and match you with the best loan offers, basic documents like Aadhaar and PAN are required. These help lenders verify your identity and income source securely.

Yes, your data is collected securely and stored on our own protected servers. It is used only for processing your loan application and will never be shared for any other purpose.

Absolutely. Once your loan process is complete or if you wish to withdraw, we will delete your documents and personal data. You can always reach us at suno@kaabharat.com for any queries or concerns.